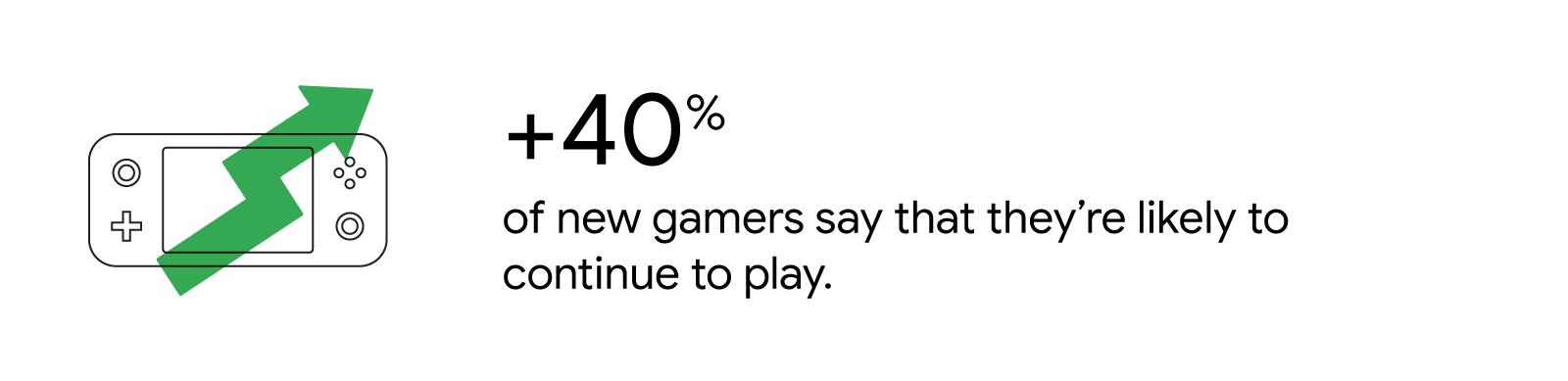

Global trends indicate an increase in playtime, session duration, and in-game purchases across all types of gamers. According to Google’s Mobile Gaming Covid-19 survey, over 40% of new players said they are likely to continue playing. Among all gamers, one-third reported being likely to spend money on games, and 65% said they would play longer per session.

In our 2020 gaming survey, we examined how the behaviors and motivations of mobile gamers worldwide have changed. Notable findings included increased investment from regular players, a willingness to engage in various countries, and incentives behind in-game purchases, shedding light on why people invest in games. Understanding these behavioral changes can help marketers reallocate investments to build long-term relationships with users, whether they are seasoned gamers or newcomers to the gaming world.

The trend of increased gaming is becoming more common.

With people spending more time at home, many are dedicating more time and money to gaming. Thirty-seven percent of all gamers have spent more money on gaming than they typically did before the pandemic, with about one-third of players making in-game purchases and one-quarter of players buying a new game.3 This year, the increase in spending is not limited to just passionate gamers. We are also seeing this among regular players, a segment known for playing without constraints or serious spending. One-quarter of regular players report that they have spent more money on games this year compared to pre-COVID-19.4

Thoughts with Google

Source: Google / Savanta, Global, Covid-19 Mobile Gaming Survey, n = 7,611 current players playing more likely occurred in May 2020.

This increased purchasing behavior is a great opportunity for game marketers to ensure they are investing in the right audience with the appropriate message. For example, if you are marketing a widely appealing game that focuses on user conversion, consider using cost per install (CPI) targeting strategies. This will help you reach a broader audience at a lower cost.

Consider using cost-per-action (CPA) bidding based on common actions for current players if your new player base is developing into a high-engagement audience. This strategy will help you find players more likely to complete meaningful actions in the game.

This increased purchasing behavior is a great opportunity for game marketers to ensure they are investing in the right audience with the appropriate message.

Deeper Engagement and Longer Missions

Many games are organizing seasonal events or special events, such as monthly tournaments, to re-engage players. While players worldwide report high levels of engagement, there is a range of incentives sometimes stacked behind the interaction on the game’s core features. For example, the survey shows that some players show more interest in subscription packages when they choose to spend on a game. Mobile gamers in Japan, South Korea, Russia, India, and China are more likely to choose subscriptions because they want more playing time and features. And mobile gamers in India, China, and the United States are the most likely to buy subscriptions because they see it as better value for money than upfront payment.

Tracking these global trends can help marketers understand how to offer and promote different in-game purchase options. For example, players in Brazil are most interested in accessing exclusive content – a detailed insight that can guide regional marketers in need of re-engagement strategies. Regional marketers can use solutions like App Campaigns for engagement to create customized messages across Search, YouTube, Google Play, and over 1 million apps to reach players who have installed their games but may have stopped playing.

For example, King, the producer of Candy Crush Saga and Candy Crush Soda Saga, was able to re-engage its players with App Campaigns for engagement. By targeting specific user segments that had become inactive, it achieved a 130% ROI and a 15% better cost per conversion for high-value players compared to user acquisition campaigns.

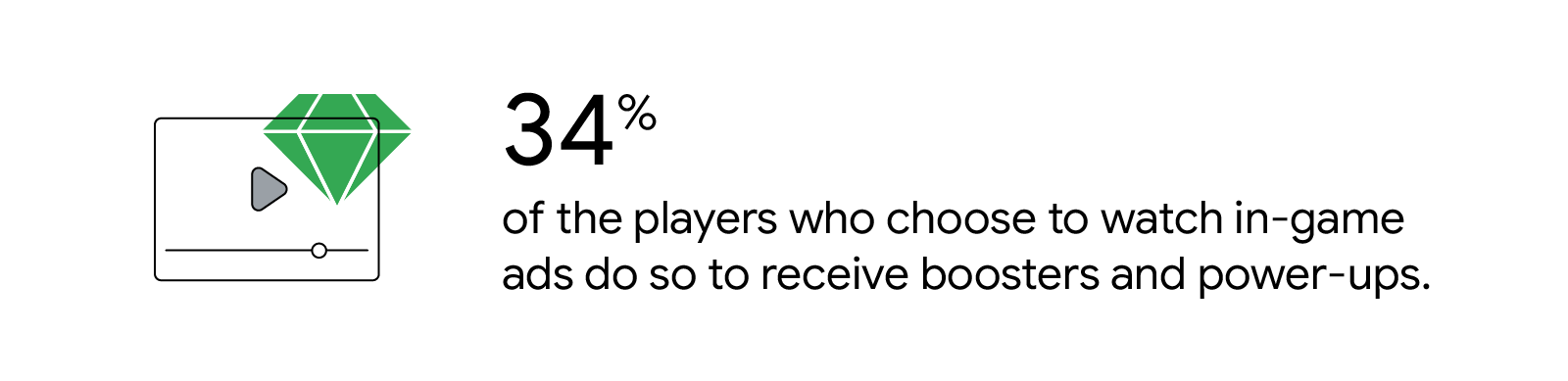

The Power of Power-Ups

For many players, the option to power up or gain strength through interacting with video ads can determine whether they reach the next level. Among players who choose to watch ads in-game, 34% do so to receive power-ups and strength, while 30% want to unlock additional lives or continue playing after an unsuccessful level. However, not all players use these opportunities to progress. For example, players in Japan primarily watch in-game ads because they want to speed up gameplay.

Think with Google

Source: Google / Savanta, Global, Mobile Gaming Covid-19 Survey, n = 10,579 current gamers, May 2020.

Marketers can capitalize on these trends by deploying one of the latest formats from AdMob: rewarded interstitial ads. This video ad format appears on the screen during breaks in the game (such as when players fail to reach a level), and players receive rewards if they choose to watch the entire video. This format offers a winning combination of high impressions, high engagement, and an easy way for players to continue playing.

While one day the world will emerge from primarily home-based living, COVID-19 has spurred a range of mobile gaming trends that are likely to persist. With both first-time gamers and enthusiastic, experienced players in the mix, now is the time to reconnect with your existing users and introduce yourself to new audiences.

Understanding user needs, Netlink is more than willing to assist publishers in monetizing their apps effectively. Please feel free to email us if you have any questions or wish to collaborate with us at [email protected].